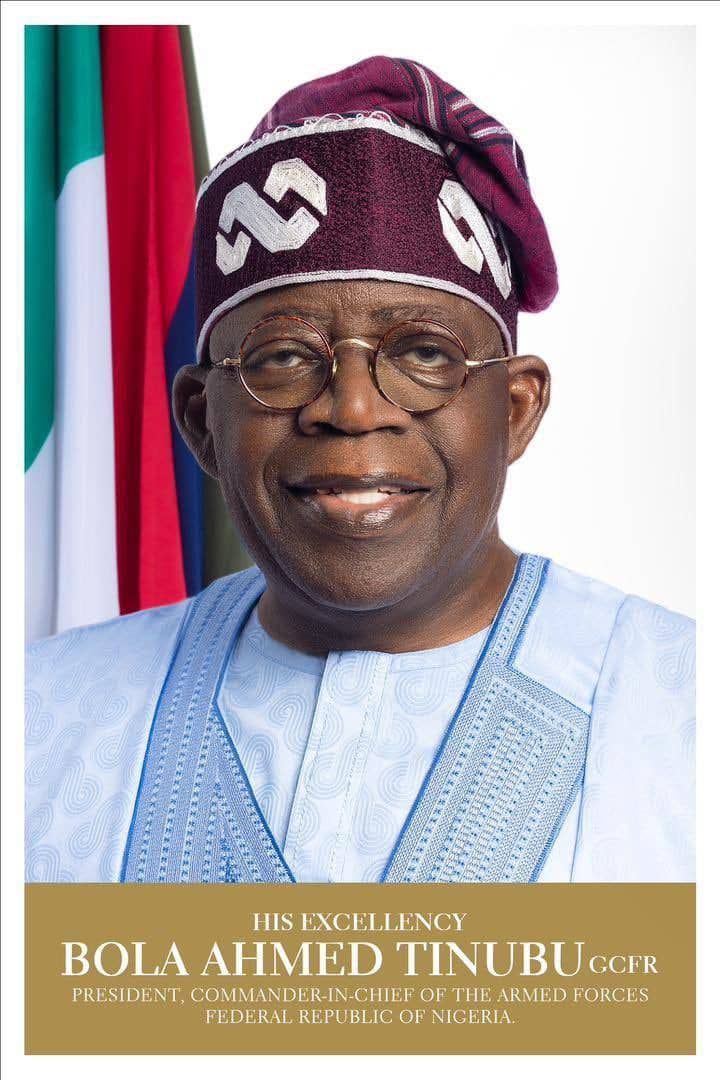

President Bola Tinubu has officially requested the National Assembly (NASS) to approve a new external loan of $21.5 billion and a ₦757.9 billion bond issuance aimed at clearing outstanding pension arrears.

In three separate letters read on the floor of the House of Representatives by Speaker Tajudeen Abbas, Tinubu outlined critical funding initiatives to stabilize the economy and improve infrastructure.

$21.5 Billion External Loan: Focus on Infrastructure and Economic Growth

In the first letter, President Tinubu sought legislative approval to raise up to $2 billion via a foreign currency-denominated issuance programme in Nigeria’s domestic debt market. This programme, spearheaded by the Debt Management Office (DMO), aligns with the Presidential Executive Order on Foreign Currency Denominated Financial Instruments, Local Issues Programme, 2023.

Tinubu emphasized that the funds would support key sectors like infrastructure, job creation, healthcare, and rail development, while also deepening Nigeria’s financial market and improving foreign exchange inflows and exchange rate stability.

The total facility includes:

- USD 21.54 billion

- EUR 2.19 billion

- 15 billion Japanese Yen

- EUR 65 million grant

These funds are expected to help Nigeria tackle the effects of the fuel subsidy removal and address the country’s infrastructure deficit.

₦758 Billion Pension Bond to Offset Arrears

In the second letter, President Tinubu requested approval for a ₦757.98 billion bond to clear unpaid pension liabilities under the Contributory Pension Scheme (CPS) as of December 2023. He noted that these obligations, delayed due to revenue constraints, are hindering retirees and lowering morale among public workers.

HEED: Follow us on Instagram or any other social media platform and get the most reliable news directly in your favourite app!

According to Tinubu, clearing this debt will:

- Alleviate hardship for Nigerian pensioners

- Restore trust in the pension system

- Stimulate economic liquidity

- Boost confidence among public servants

- The Federal Executive Council (FEC) approved the bond issuance on February 4, 2025.

- Implications: Rising Debt, But Promised Accountability

President Tinubu admitted that both initiatives will increase Nigeria’s public debt and debt servicing costs, but assured the lawmakers that the funds would be used transparently to support national development priorities.

He urged the National Assembly for swift approval and reaffirmed his administration’s commitment to economic recovery, poverty reduction, and infrastructure growth across all 36 states and the FCT.

The House has referred the requests to the Committee on National Planning and Economic Development and the Committee on Pensions for further legislative review.

NaijaBlogDaily# is visible on all social media platforms, and we bring you the latest Nigerian news on politics and economy, entertainment, and celebrity updates, including sports across Nigeria and beyond…

Keep visiting and following up with us on any social media platform you are using to keep you updated 💯

Remember (information brings knowledge and power).

STAY TUNED!!!