September 6, 2025-Published by Cyril

Confusion has spread across social media over reports of a 5% fuel surcharge under Nigeria’s new tax laws, with many Nigerians fearing an immediate hike in fuel prices.

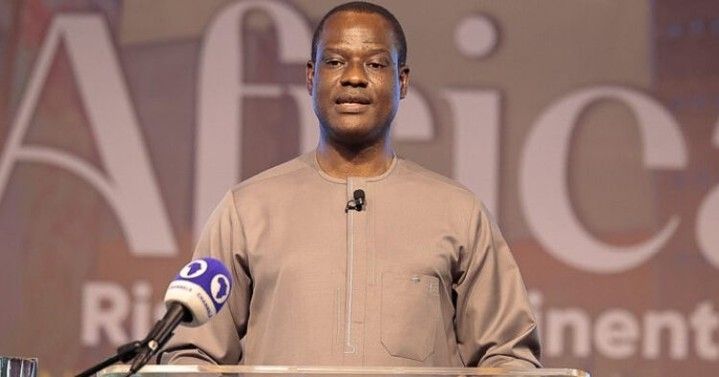

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, clarified on Saturday via a post on X that the charge is not a new tax introduced by the Tinubu administration. Instead, it is a provision that has existed since the Federal Roads Maintenance Agency (Amendment) Act of 2007. Its restatement in the Nigeria Tax Act, 2025, is simply for harmonisation and transparency, not immediate enforcement.

Oyedele explained that the surcharge is intended to create a dedicated funding source for road infrastructure, which has historically suffered chronic underfunding. Nigeria’s poor road network has long led to potholes, travel delays, and high vehicle operating costs, making predictable funding essential.

Key clarifications from Oyedele:

- Not Immediate: The surcharge will not take effect automatically in January 2026. It will only commence when the Minister of Finance issues an official order published in the government gazette.

- Exemptions: Household energy products such as kerosene, LPG, and CNG, as well as clean energy products, are exempt to support Nigeria’s energy transition agenda.

- Purpose: The fund is designed as a dedicated mechanism for road construction and maintenance, ensuring safer travel, reduced logistics costs, and long-term economic benefits.

- Global Practice: Over 150 countries impose similar surcharges ranging from 20% to 80% of fuel prices to sustain road financing. Nigeria’s proposed 5% is modest compared to international standards.

- Subsidy Savings Not Enough: While subsidy removal provides some funding, Oyedele stressed it is insufficient to meet Nigeria’s massive road infrastructure needs, hence the need for a predictable, ring-fenced fund.

HEED: Follow us on Instagram or any other social media platform and get the most reliable news directly in your favourite app!

- No Contradiction: The reforms aim to reduce multiple taxes by consolidating levies, removing VAT on fuel, excise tax on telecoms, and suspending the cybersecurity levy, thereby easing citizens’ tax burdens.

- Future Preparedness: The surcharge is included in the harmonised tax law framework to ensure Nigeria has legal readiness to address road financing and climate-related infrastructure challenges when necessary.

In conclusion, Oyedele emphasised that the fuel surcharge is not new, not immediate, and not universal. Instead, it is a forward-looking legal framework aimed at sustainable infrastructure funding and closing long-standing gaps in road maintenance across Nigeria.

NaijaBlogDaily# is visible on all social media platforms, bringing you the latest Nigerian news on politics, economy, entertainment, and celebrity updates. Including sports across Nigeria and beyond…

Keep visiting and following up with us on any social media platform you are using to keep you updated 💯

Remember (information brings knowledge and power).

STAY TUNED!!!